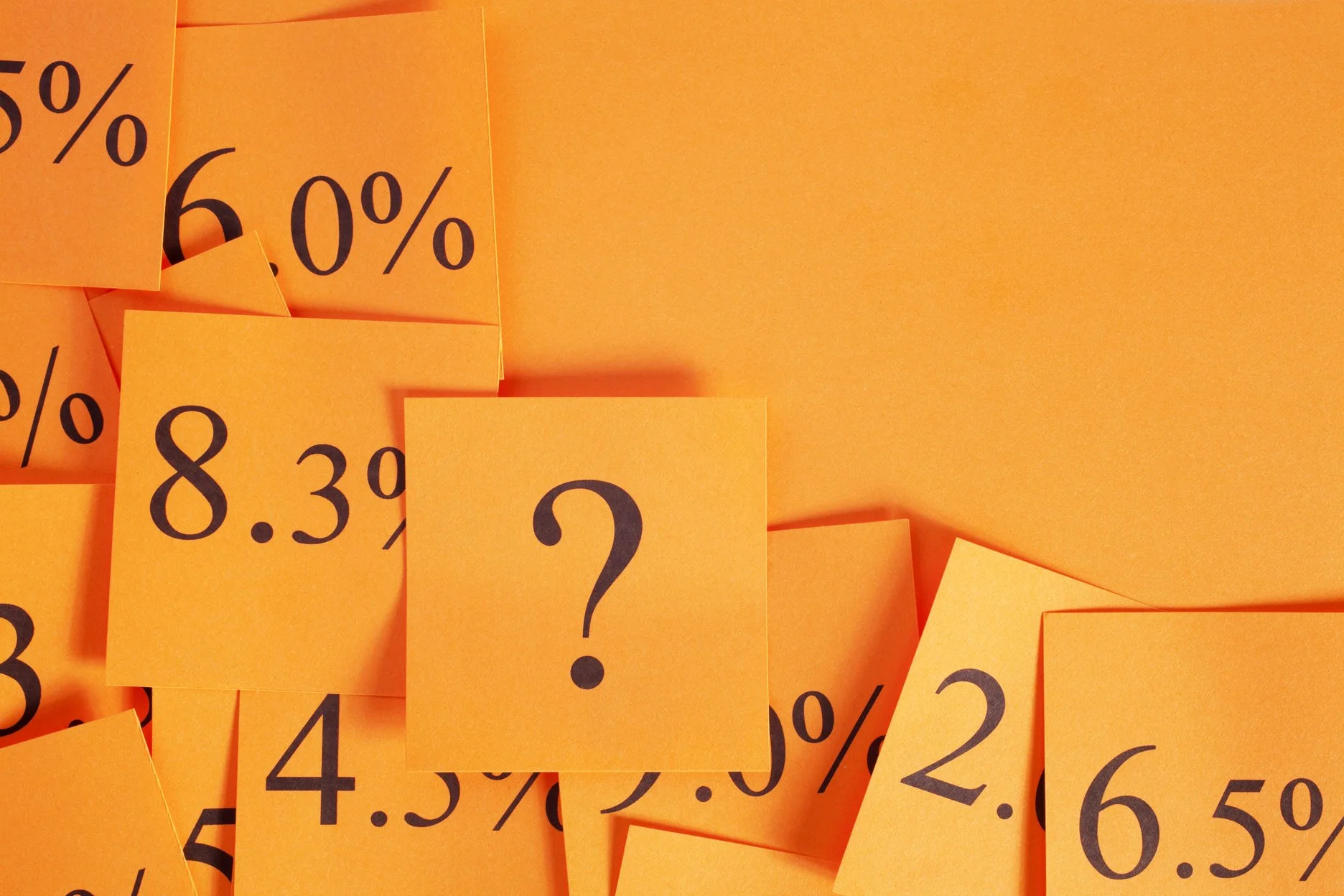

RICK MAGGI Certified Financial Planner, Managing Director of Westmount Financial (Perth CBD).

Perth-based Financial Advisor Rick Maggi has dedicated over 40 years to helping clients achieve financial independence, offering investment and retirement solutions that are both resilient and refreshingly simple to manage.

With experience guiding clients through various economic cycles, geopolitical shifts, and personal life changes, Rick understands the value of accessible, thoughtful financial advice and continuous support. Founded in 1977, Westmount Financial embodies this commitment to clarity and stability in financial planning.

A clear path FORWARD

Clarity (and action) is the cornerstone of success. Your financial and retirement goals become far more attainable when your vision, priorities, and values guide your decisions.

Studies show that individuals who engage a Financial Advisor often experience greater happiness, increased wealth, and a stronger sense of control over their future. Reflecting this trend, the demand for authentic, goals-based advice has grown significantly in recent years.

With a broader range of financial planning services now available, Australians have more choice than ever. While most prefer accessible, tailored advice, it’s vital to consider your personal circumstances—because when it comes to your future, one size never fits all.

Keeping it simple

A skilled Financial Advisor helps clarify your goals, develop practical strategies, and guide you toward the lifestyle and retirement you envision, offering continuous support along the way.

An advisor will simplify the complexities of retirement planning and wealth management, empowering you with the confidence and insight to make well-informed financial decisions—easily and effectively.

If retirement has been occupying your thoughts lately, you’re likely picturing a future filled with travel, hobbies, well-deserved “me-time,” and finally savoring experiences you’ve put off for years. It’s a vision of clear skies ahead.

At the same time, you may be quietly running the numbers, wondering whether you can retire comfortably—or perhaps scale back to just a few days of work each week. If these thoughts resonate, now is the perfect moment to tackle these questions head-on.

By taking the time to unravel the retirement puzzle, you can not only fortify your financial outlook but also embrace a greater sense of calm, confidence, and certainty about the years ahead.

If you find yourself at this pivotal crossroads, seeking guidance from a seasoned Financial Advisor can provide invaluable clarity and a trusted second opinion.

2026: TIME T0 REASSESS?

As the new year begins, the world continues to grapple with a complex mix of challenges - from trade tensions and regional conflicts to the rapid rise of AI, persistent inflation, and elevated interest rates. Although Australia’s economic outlook remains relatively stable, underlying risks continue to pose concerns.

In uncertain times, stepping back to assess the broader landscape can bring valuable clarity and peace of mind. Keeping a measured distance from the noise of daily headlines and market speculation may, in itself, be one of the most prudent investment decisions you could make.

Successfully navigating the next few years will require thoughtful planning and a steady perspective. Partnering with an experienced Financial Advisor will help you stay on course, adapt to the inevitable market fluctuations, and remain focused on your long-term financial aspirations.

Rick Maggi CFP, Financial Advisor (Perth), Westmount Financial.

Vince & Julie (Mosman Park)

Alan (Launceston)

Lee & Val (Mosman Park)

David & Rae (Dunsborough)

Peter & Carol (Swan Valley)

Ron & Shirley (Banjup)

David & Joanna (Helena Valley)

Lorna & Lionel (Piesse Brook)

News Updates…

AMP’s Dr Shane Oliver reviews 2025 , but also looks forward to the coming year. A good read.

Bullock’s grim warning about the future…

No surprise - interest rates in a holding pattern…

Australian home prices rise solidly, but slower gains are likely in 2026…

Vanguard’s forthcoming economic report should be an interesting one…

The positives and negatives for shares…

How to use the zero-budget method…

Today’s decision was a predictable one - but is this already the end of rate cuts?

As markets continue to power ahead, it’s wise to consider where we might be now and the potential risks ahead…

Last week’s announcement was a win-win for retirees…

Beware of pushy sales tactics targeting your super…

The RBA needs to see a sustained reduction in inflation before cutting much further…

Unsurprisingly the RBA left interest rates rates on hold today - and is in no rush to drop.

Vanguard’s newly released How Australia Retires 2025 report explores how Australians prepare for and experience retirement…

Remarkably, despite the poltical upheavals of late, the local and global economy continues to chug along…

Words of wisdom from the founder of Vanguard Investments…

Helpful insights to reach your financial goals….

If you receive the Age Pension, upcoming changes from 20 September could affect your payments…

ASIC has issued a warning about a new wave of investment scam websites using images of well-known Australian identities.

A summarised investment and economic outlook report from Vanguard (technical)…

Planning is important, but execution is essential…

Investing is a marathon, not a sprint…

Taking a DIY approach to managing your finances will save you a little money in fees, and if you enjoy the subject, more power to you. But is this a false economy? The value of financial advice goes well beyond investment or retirement planning, setting goals, wealth accumulation/preservation and superannuation…

Tailoring your retirement strategy based on your personal data could be invaluable…

Between geopolitical uncertainty on one side and the very real possibility of further interest rate cuts on the other, Australian real estate is in a strange place. So where to from here?