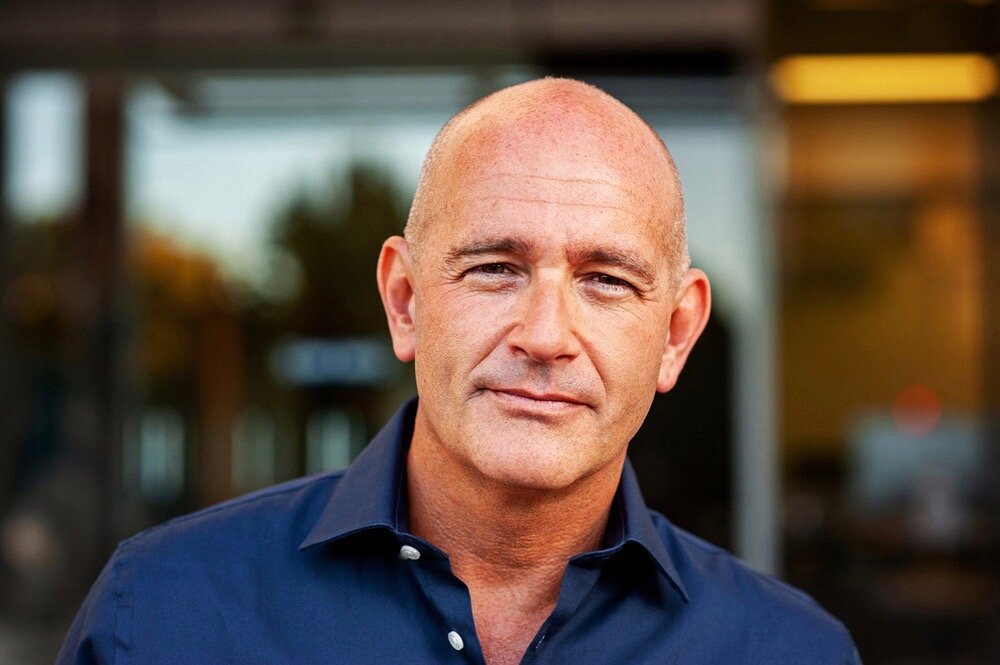

RICK MAGGI Certified Financial Planner (CFP), Westmount Financial.

Perth-based Financial Planner/Advisor, Rick Maggi, helps his clients grow and maintain their wealth, while minimising unnecessary complexities and jargon. Friendly, approachable financial advice and support for over 40 years.

The power of purpose.

Clarity is everything. Achieving your personal and financial goals, whatever they may be, is far more likely if your vision, priorities, and values, are placed front and centre. The good news is that taking some time to reflect, dig a little deeper, and focus on what matters most, is typically a positive, engaging experience, not a chore.

Perth-based Financial Planner, Rick Maggi (Westmount Financial), has been helping clients achieve financial independence for over 40 years, creating resilient investment and retirement solutions that are easier to understand and refreshingly simple to manage.

Having guided his clients through numerous economic cycles, geopolitical events, and life/family changes, Rick appreciates the importance of having easy, immediate access to well considered financial advice and ongoing support.

Forward motion.

Research suggests that longer term clients of Financial Advisors are generally happier, wealthier, and feel more ‘in control’. Demand for authentic ‘goals-based’ financial advice has grown exponentially in recent years.

Consumer choice is also evolving, with a multitude of financial planning services now on offer, ranging from institutionally driven digital advice to comprehensive, holistic, personal advice. While most Australians generally favour a service that sits somewhere in the middle, it’s important to do your own research and seriously consider which option might best suit your individual circumstances both today, and in the coming years.

Our aim is clear - to inform, simplify and support. We break down and demystify the often complicated world of investing, superannuation, retirement planning and taxation, so that our clients can make informed financial decisions, and move forward with greater confidence.

Westmount Financial was established in 1977.

Mid-2024: Time to reassess?

It’s already mid year, and yet despite having successfully emerged from an economic downturn, a variety of worries continue to weigh on public confidence - inflation, interest rates, and a fragile geopolitical climate have all been contributing to a general ‘vibecession’ in Australia.

In an uncertain environment, it’s important to take a breath, calmly survey the economic landscape, revisit your priorities and, if necessary, fine-tune your investment or retirement strategy - building and preserving your wealth over the next few years will require a clear perspective.

An experienced Financial Advisor can help clarify your objectives, and map-out proven strategies to achieve your lifestyle goals, while supporting you (and your family) along the way. So this year, consider replacing media speculation and fear-driven news editorials with a fresh focus on the very real benefits of creating a stronger, vibrant, financial future.

Speak with your financial advisor, or if you don’t have one, contact us for an initial meeting.

Rick Maggi

Vince & Julie (Mosman Park)

Alan (Launceston)

Lee & Val (Mosman Park)

David & Rae (Dunsborough)

Peter & Carol (Swan Valley)

Ron & Shirley (Banjup)

David & Joanna (Helena Valley)

Lorna & Lionel (Piesse Brook)

A Financial Advisor who is a member of the Financial Advice Association of Australia (FAAA), is committed to a strict education regimen and a code of ethics and professional conduct, with your best interests always front and centre.

News Updates…

Thinking about accessing your superannuation as you move closer to retirement?

Interest rates may stay higher for longer - great for income investors, but how about share investors?

The RBA announces May rate decision amid economic challenges…

Another EOFY superannuation tip to consider…

Are seasonal patterns a reliable guide for investors?

Last week markets were relieved the Fed chair Powell played down the risks of another rate hike…

Paying lower super fees will ultimately add up to a higher retirment balance…

Another superannuation tip to consider…

The third stage of the tax cuts that were announced in the 2018-19 Budget and amended in the 2019-20 Budget have been further amended by legislation enacted in March 2024. So what are they?

Claiming a tax deduction this year? Be mindful…

Economics and the “hedonic treadmill”…

An EOFY tip on salary sacrificing into superannuation…

Today’s economic and market update from David Bassanese…

Vanguard’s region by region economic outlook…

Why billionaire active investor Warren Buffett is also an avid supporter of index funds…

Sounds a little boring or obvious doesn’t it? But knowing your Total Superannuation Balance or ‘TSB’ will give you (and your Financial Advisor) a clear eligibility pathway to taking advantage of generous super concessions.

Does diversification still make sense?

With the EOFY fast approaching, its important to do a little houskeeping to see if you’re taking full advantage of the generous tax concessions available in superannuation…

Correction continues…A market update from David Bassanese…

Australian investors have been lifting their exposure to international shares…

Shares are vulnerable to a bout of volatility, but here’s five reasons why the trend will likely remain up…

Let’s get up to speed on some commonly used jargon…

Markets finish the week with a whimper…

The Australian housing market has started the year on a solid note with national home prices up 1.6% over the first three months according to CoreLogic. We had thought the drag of high mortgage rates would get the upper hand again but the supply shortfall is continuing to dominate…

You may have heard it said, "No risk, no reward." But did you know that time can actually decrease your risk while increasing your reward?

How parents and advisers can work together…

Having a legally valid will can go a long way to avoiding disputes over division…

The Age Pension still falls short…

Using income distributions to purchase additional ETF units can significantly compound capital growth and income returns over time…